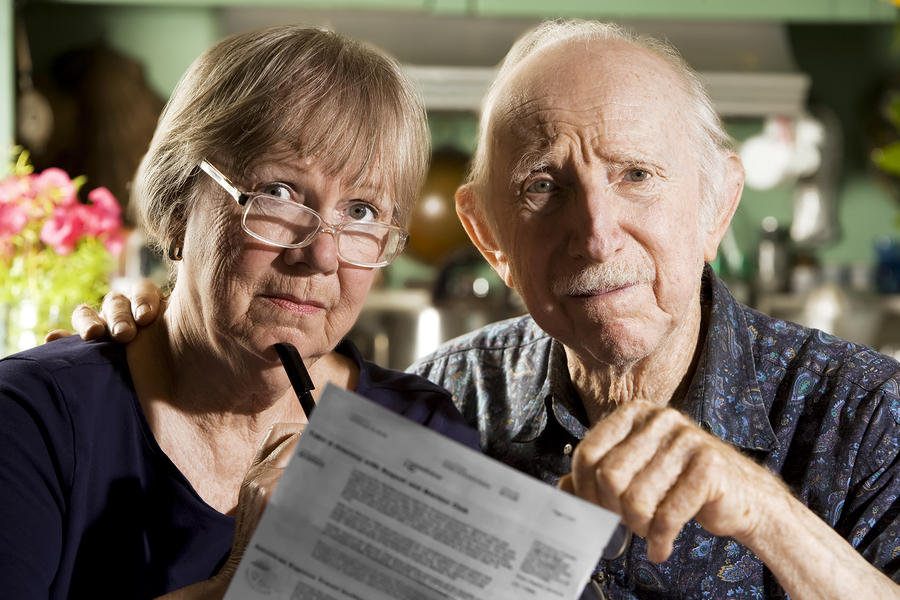

“In case you didn’t see the news, those on Social Security won’t be getting a very generous raise this coming year.”

The annual Cost of Living Adjustment, aka COLA, for 2020, is a smidge of an increase: 1.6%. That’s only slightly more than half of the 2.8% COLA for 2019. For the average beneficiary that means about $23.50 more per month, says the Globe Gazette’s article “Disappointed in Your Social Security Raise? 3 Steps to Take“. It’s a lot like getting a tiny raise that doesn’t budge the budget needle at all. Remember, there’s also going to be an increase in Medicare Part B, which is expected to rise by $8.80. That puts a raise of just $14.70 per month in benefits, once New Year’s Day passes.

The problem is that healthcare costs are continuing to climb. That puts seniors in a bind, especially those who count on Social Security for the bulk of their retirement income. Is there anything you can do to beef up your income?

Review and revise your budget. You needed a budget when you were working, and you really need one in retirement. If you are using up all your available income every month, it may be time to make some changes. Maybe it’s finally time to clear out the big sprawling ranch and downside to a two-bedroom condo. Going from a two-car household to a one-car family could net considerable savings. If you eat most of your meals out at restaurants, consider trimming those outings to cut spending.

Work part-time. You likely have a lot of time on your hands, as a retired person. Getting a part-time job during retirement has a number of benefits. One, you have less free time to spend money, two, you have income and three, you have more social interactions during working hours. There’s also no need to accept a job that you wouldn’t want. Maybe you are great at baking and can turn that into a side business, or dog walking or crafting. Pet-sitting and babysitting are in demand.

Move somewhere less expensive. The cost of living varies greatly from state to state. Look for states that don’t tax Social Security and that offer a lower cost of living and a relatively low income tax rate. However, check your Medicare benefits. Medicare Advantage and Part D plans vary from state to state. If you have supplemental insurance through Medigap, the cost of your plan may change.

If much of your retirement income budget is based on Social Security, be prepared to make some changes. You can stretch those benefits and, at the same time, lessen your stress.

Reference: Globe Gazette (October 14, 2019) “Disappointed in Your Social Security Raise? 3 Steps to Take”