Category: Power of Attorney / POA

“Estate planning documents often are treated like the photocopied permission slip for a child’s field trip. You fill in your name, include the children’s names and dates of birth and sign. The document is filed away to be used if needed, but you really never expect it to be used.” The only thing worse than […]

“Without an estate plan in place, clients will be reliant on state laws and probate courts to appoint individuals who will be responsible for financial affairs and health-care decisions, in the case of illness and ultimately the transfer of assets upon death.” The continuing escalation of the COVID-19 pandemic has forced many people to finalize […]

“COVID-19 is quickly becoming the leading cause of death in the United States. As of today, Indiana has over 37,000 cases of COVID-19 and over 2,100 deaths. That is why articulating your wishes regarding end-of-life health care, is more important than ever.” The number of Americans who have died in the last few months because […]

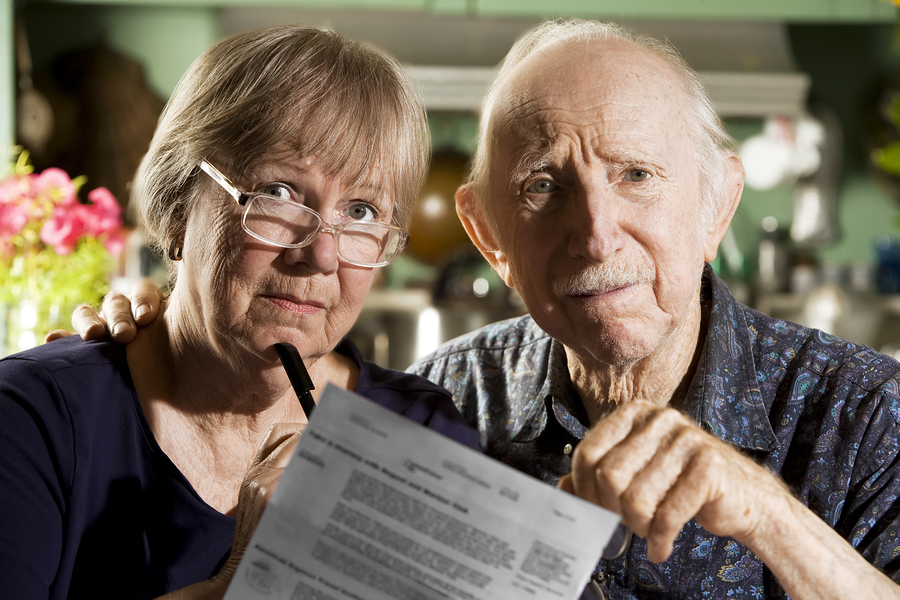

“Seniors are especially at risk during the coronavirus pandemic. The numbers are shocking.” The numbers are frightening, especially for those over 80. By the time seniors with COVID-19 are admitted to the hospital, it’s usually too late to do anything about their legacy. This topic was taken up recently in the article “Tips for protecting […]

“It’s never too early to start working on how your things will be handled, once you pass away.” Estate planning is an all-encompassing term that refers to the entire process of gathering and organizing assets and making preparations for when you die, including caring for minor children and heirs. It also includes putting protections into […]

“Without a proper elder law estate plan, the children’s responsibilities are even more exhausting, stressful and sad.” It is the adult children who oversee aging parents when they need long-term care. They are also the ones who settle estates when parents die. Even if they can’t always come out and tell you, the recent article, […]

“If your will was signed before 2013 and you have a so-called by-pass estate tax saving trust that is no longer necessary, you really should update and simplify your will.” Estate administration, that is, when the executor gets busy with paying debts, taxes and distributing assets, is often the time when any missing steps in […]

“The official figure for elder financial fraud used by a congressional committee is around $3 billion a year, but that’s based solely on reported cases of fraud. Other estimates are 10 times that much.” Aging baby boomers are a giant target for scammers. A report issued last year from a federal agency, the Consumer Financial […]

“Under Illinois law, an individual holding a power of attorney is a fiduciary as a matter of law. The person designated as a power of attorney agent owes a fiduciary duty to the principal—the person making the designation.” A recent case examined the issue of when the fiduciary duty begins for an agent who has […]

“It’s hard to imagine being stripped by a court of the right to make decisions about finances, medical care and other matters. It’s even harder to imagine that happening without representation or the advice from a lawyer.” In many states, if a person is deemed unable to conduct their own affairs, a court appoints a […]