Category: Estate Planning

Clients with swiftly appreciating assets can transfer these assets and escape both gift and estate taxation on almost all of the appreciation using a combination GRAT-life insurance strategy in connection with the steep gift tax valuation discount available today. Despite this, the Administration has often threatened to eliminate the tax benefits that can be realized […]

When you inherit property, such as a house or stocks, the property is usually worth more than it was when the original owner purchased it. If you were to sell the property, there could be huge capital gains taxes. Fortunately, when you inherit property, the property’s tax basis is “stepped up,” which means the basis […]

“It’s not that these accounts can’t or shouldn’t be used, it’s just they have to be coordinated carefully with the rest of the plan,” says Patrick Lannon, an estate lawyer with Bilzin Sumberg in Miami, Fla. “If there is more than one child and you make a paid on death account in favor of just […]

It is indeed possible for a charitable gift annuity, a charitable remainder unitrust, a charitable remainder annuity trust, a life estate agreement or a pooled income fund to be converted into a current gift. Have you considered expanding your generosity through a unique kind of charitable gift that is structured to actually “give back”? Examples […]

We all want to be remembered, to feel that we’ve contributed something to the world. For some, this can be a driving force leading to great accomplishments and extraordinary contributions to mankind. But for most of us with more modest goals, what pushes us is the desire to leave a legacy. Do you know the […]

If you live in one of the states with an estate tax, you need to take the tax into account when planning your estate … Another state tax to take into account when planning your estate is the inheritance tax. Just when you think you’ve got the whole federal estate tax figured out, you may […]

Many families today are living with trusts that their ancestors established decades ago. In each case, there’s a definition of “family,” either explicitly written into the trust or, by default, applied by its governing law. There are innumerable ways that these trusts might define which family members are eligible to be beneficiaries and/ or remaindermen of […]

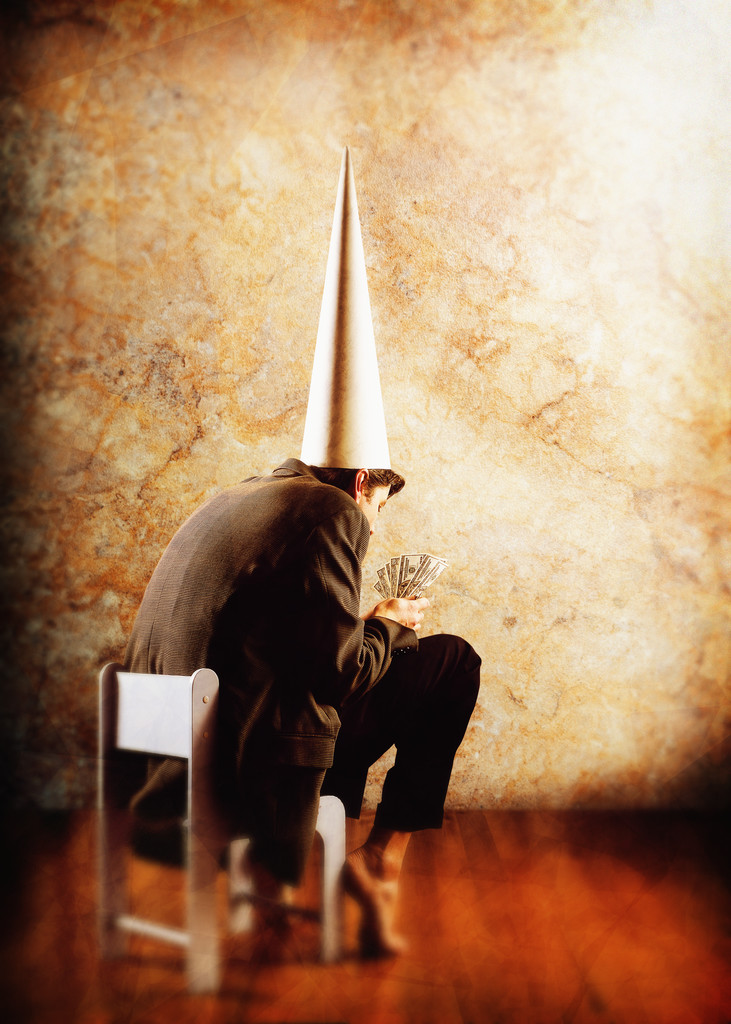

Failure isn’t something that most people plan for and that’s a serious mistake. Small business owners know more than anyone about the realities of bankruptcy, either in the form or near-misses or through personal experience. Consequently, no one needs to protect their assets quite as thoroughly or understand bankruptcy like a small business owner. If […]

“This is the thing people who disinherit someone don’t understand: It puts a huge amount of pressure on those who aren’t being disinherited,” says Caschetta, whose experience inspired her to write a book on the subject that she’s trying to get published. “Suddenly you have this rift and they have this choice. ‘Do I do […]

In general, the value of an easement is the value of the property’s development rights. But in practice, these financial values are far more nuanced and flexible. Do you know the fundamentals of conservation easements? If not, then you might want to do your homework before exploring this charitable tool. Better yet, you really ought […]