Category: Estate Planning

One surprising area in which scams are becoming more common is estate planning. Each year, more people fall victim to unscrupulous and unqualified sellers of ineffective estate planning documents. Often, these scammers are door-to-door salesmen or telemarketers. Scams are everywhere if you look close enough. And the field of estate planning is no exception. A […]

Knowing these objectives help both the couple and their estate planner determine what might be the best way to structure their estate plan. Planning for one’s estate takes careful thought and consideration. By adding another person to the mix through marriage, your goals or objectives will likely change. A recent Forbes article, titled “Eight Common […]

One way to fulfill your philanthropic goals is to provide for a particular charitable cause or organization in your estate plan. Do you want to leave something to charity when you are no longer here? All it takes is some planning ahead of time. The Charlotte County Florida Weekly recently posted an article titled “GIVING: […]

For many, the decision to remain single is a matter of money. A partner who remarries stands to lose alimony, Social Security or a survivor’s pension. Many cohabitating couples share assets and expenses informally. Attorneys are constantly on their unmarried clients to draw up agreements specifying which partner is responsible for expenses and who will inherit. These […]

The bill has been in the works for more than three years and has backing from the Delaware Bar Association. If approved, it would be the first comprehensive law of its kind. Seven other states grant different levels of access. Accessing a decedent’s email or other online accounts after his or her death can be […]

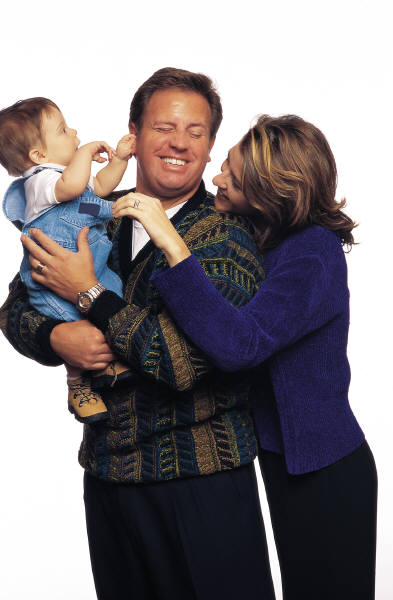

Being a parent is full of surprises and requires constant judgment calls and adaptation. Try as you might to cover all the bases, ultimately you need to choose the people whom you really trust to do the right thing, and hope for the best. What if something happens to you today, tomorrow, next week … […]

Today, with smaller families and more women choosing not to have children, “the dynamic has changed pretty significantly for the generation of baby boomers. The option of doing something charitably significant with their estates is a change. What you do with your estate is up to you. Sometimes that means passing it to your family. […]

If you are expecting an outright inheritance, you may need to think again. Expecting a sizeable inheritance? A recent Forbes article, titled “Why You May Not Get An Inheritance (And What To Do About It)“, provides some sound advice and thoughts to ponder. Good (and recent) financial decisions. Parents like to see a pattern of […]

To grasp the importance of planning for the distribution of your worldly goods, consider all the things that influence what happens to them. An Estate Plan is a form of defense for your estate. But you also need to defend that plan against future influences. A recent Kiplinger’s Personal Finance article, titled “Forces That Affect […]

Federally insured reverse mortgages, issued under the Home Equity Conversion Mortgage program, are a way for homeowners 62 and older to borrow money using their home equity as collateral. Reverse mortgages can be costly, but are (in some cases) the only option for older homeowners without cash and who have mounting health care expenses. A recent […]