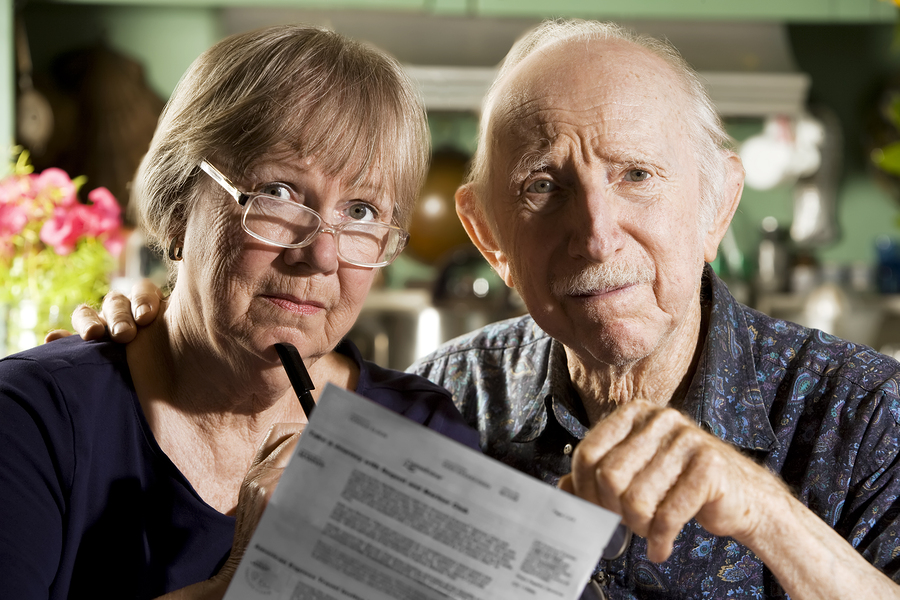

It may not be the best time when the pressure is on. However, read the contract and get some advice.

If you are preparing to move to a retirement community or care community yourself, it is best to read that fine print very carefully and better yet, get some legal advice before signing, according to the Delco Times in “Planning Ahead: Moving to a care community? Read the agreement.”

If you don’t want to read the fine print or can’t make head or tails of what you are reading, one option is to ask your estate planning attorney to do so. Without someone reading through and understanding the contract, you and your family may be in for some unpleasant surprises. Here are some things to consider.

What kind of a community are you moving into? If you are moving to a Continuing Care or Life Care Community, your documents will probably have provisions regarding health insurance, entry fees, deposits, a schedule of costs if you need additional services, fees for moving to a higher level of care and provisions for refunds and estate planning.

When you enter an Assisted Living facility, which is referred to as “Personal Care” in Pennsylvania, you may find yourself signing documents regarding everything from laundry policies, pharmacy choices, financial disclosures and statements of your rights as a resident. Not every document you sign will be critical, but you should understand everything you sign.

If moving into a nursing home that accepts Medicaid, you and your family need to know that nursing homes that accept Medicaid are not permitted to demand payment on admission from either an adult child or a power of attorney from their own funds. However, Pennsylvania does have support provisions regarding children, that are called “filial responsibility.” This should not be a problem, as long as you speak with an elder law attorney who can make sure you have completed the Medicaid application correctly and are in full compliance with all of the requirements in your state.

If your adult children ask you to sign documents and say “don’t worry” about what documents are, you may want to sit down with an attorney to review the documents. When someone is not trained to review these documents, they won’t know what red flags to look for.

If someone signs the document who is not the applicant/future resident, that person may become responsible for the costs, depending upon what role you have when you sign: are you a guarantor or indemnitor? That person typically agrees to pay after the applicant/resident’s funds are exhausted. The payments may have to come from their own funds. Sometimes the “responsible party” is simply the person who handles business matters on the applicant’s behalf. You’ll want to be sure that the person signing the papers understands what they are agreeing to.

Almost all agreements will say that the applicant, or the person receiving services, is responsible for payment from their own assets. However, if someone signing the documents is power of attorney, they need to be mindful of what they are signing up for.

If possible, the person who will receive services should be the one who signs any paperwork. This would also be a good time to have an estate planning attorney read the contract and offer any advice, as needed.

Reference: Delco Times (Feb. 5, 20-19) “Planning Ahead: Moving to a care community? Read the agreement”