There are some lessons to be learned from the experience of others.

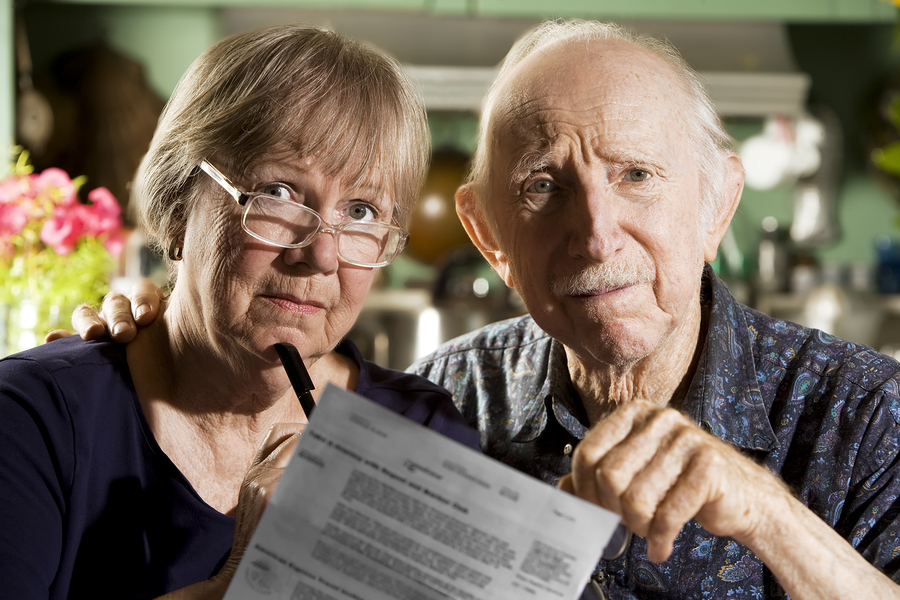

Things do not always go as we plan. A couple planned and saved for their retirement but then faced some tough challenges, according to the Canton Citizen in “Smart About Money: Retirement Lessons“.

The article details the story of an 80-year-old man who retired from a mid-sized company with a “guaranteed pension.” The pension may have been guaranteed, but what was not guaranteed was the amount of his monthly payments. They were cut, several times.

He and his wife were receiving about a third of what they had counted on receiving, which created a financial hardship they never anticipated. They did what they could with their budget, but had to tap into their savings, which were nearly gone.

Friends suggested a reverse mortgage, but they were reluctant to do so. Their home was their only asset, and they didn’t want to find themselves with nothing.

Their regrets?

The man wished he had gotten a part-time job after retirement. They could have lived frugally on this income and let his pension continue to grow. They were considering, even at this late stage in their lives, getting part-time work just to give themselves a few hundred dollars a month, in addition to their Social Security income.

He also wished he had never trusted his pension “guarantee.” He wished that he had multiple income buckets for retirement. A pension and Social Security are two buckets, but a third and a fourth would have given them more income, which as it turned out, they desperately needed.

Finally, he said that he wished he and his wife had devoted more time to planning for their retirement years to last far longer than they had anticipated. They are both likely to live into their 90s, or even to 100. They had no idea they would need income for a three- or four-decade retirement.

There are no guarantees in retirement planning but having multiple sources of income makes it far more likely that your retirement income will be enough to live on, and hopefully enough to enjoy the things you want to do during retirement.

Social Security is not a guarantee, although it has been dependable in the past. It is possible that this government agency will face challenges in the future. Fewer and fewer workers have pensions of any kind. Instead, we rely upon our 401(k) and IRAs to keep growing. A plunging stock market could take a bite out of those funds. Personal savings that grow over time and home ownership are worthwhile goals, but real estate prices do fluctuate.

An estate planning attorney can advise you on creating an estate plan that fits your unique circumstances and suggest options for effectively funding your retirement.

Reference: Canton Citizen (Dec. 16, 2018) “Smart About Money: Retirement Lessons“